Blog

Our vision is to revolutionize and automate the loan servicing workflow of the global financial community.

Streamlining Bankruptcy with Shaw Loan Servicing Software and BankruptcyWatch

Bankruptcy proceedings can be complex and time-consuming for both borrowers and lenders. Shaw’s loan servicing software, combined with BankruptcyWatch, provides a powerful tool to help lenders streamline and automate bankruptcy. It enables lenders to navigate bankruptcy cases efficiently, reduce costs, and enhance operational effectiveness. It automates bankruptcy notifications, streamlines case management, improves recovery rates, and provides flexible processing options.

Bankruptcy proceedings can be complex and time-consuming for both borrowers and lenders. Shaw’s loan servicing software, combined with BankruptcyWatch, provides a powerful tool to help lenders streamline and automate bankruptcy. It enables lenders to navigate bankruptcy cases efficiently, reduce costs, and enhance operational effectiveness. It automates bankruptcy notifications, streamlines case management, improves recovery rates, and provides flexible processing options.Enhanced Case Management

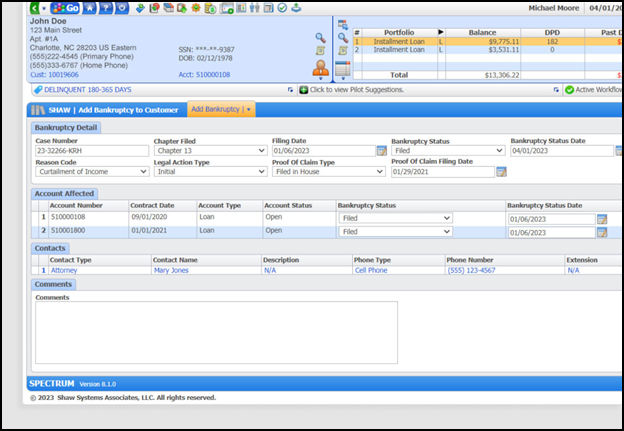

Shaw’s Spectrum system offers lenders a platform to manage bankruptcy cases from start to finish. It provides a centralized repository for storing critical information, including bankruptcy filings, court documents, communication history, and relevant financial data. With easy access to this information, lenders can efficiently track and manage the status of each bankruptcy case, ensuring timely and accurate responses.

Bankruptcy cases require strict adherence to regulatory guidelines and compliance standards. Our loan servicing software helps lenders ensure compliance by integrating regulatory requirements into the workflow. The software ensures that lenders are compliant with federal regulations. It generates audit trails and documents every action taken throughout the bankruptcy process.

Communication and Collaboration

Effective communication and collaboration are crucial during bankruptcy proceedings. Spectrum facilitates seamless communication between lenders, borrowers, attorneys, and court officials. The software allows for secure messaging, document sharing, and real-time updates, ensuring everyone can access the most up-to-date information.

Cost Reduction and Operational Efficiency

Automating and streamlining the bankruptcy process can significantly reduce operational costs for lenders. Lenders can save time and money by eliminating manual tasks and reducing errors. Improved efficiency enables lenders to handle more bankruptcy cases without compromising quality, increasing their capacity to recover loans.

These tools have changed the way lenders approach bankruptcy cases. By automating bankruptcy notifications, streamlining case management, and ensuring compliance, this solution empowers lenders through the entire bankruptcy process. With reduced costs, increased efficiency, and improved decision-making, lenders can navigate bankruptcy proceedings more effectively, benefiting both the lenders and borrowers.

Automated Workflows

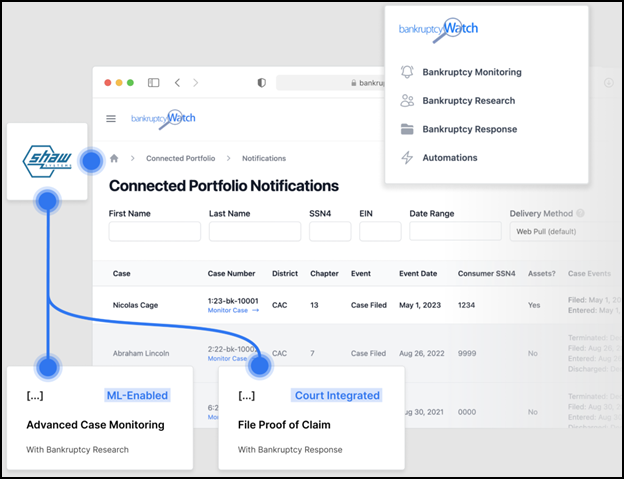

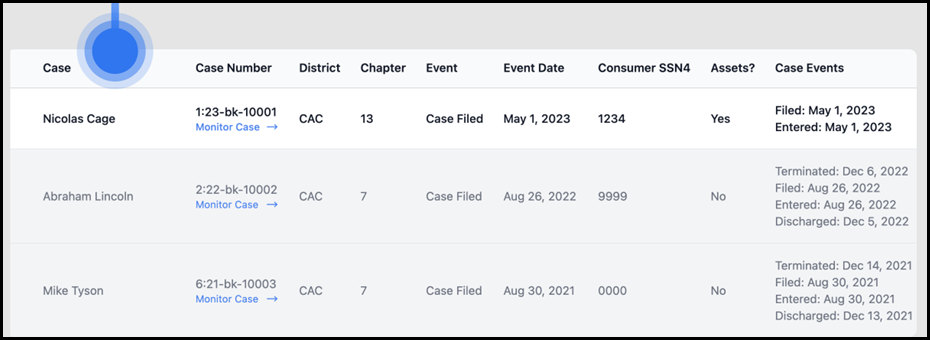

Spectrum and BankruptcyWatch streamline workflows, such as filing notifications, customer communications, court data retrieval, and document filing, by leveraging predefined rules and workflows. This automation reduces the risk of errors, improves efficiency, and allows lenders to focus on more strategic aspects of the bankruptcy process.

Bankruptcy monitoring is essential, and with Spectrum and BankruptcyWatch, monitoring is seamlessly integrated into existing workflows. Consumers are scrubbed when onboarded to make sure filings aren’t slipping through the cracks, and bankruptcy filings are matched daily to provide notifications for every relevant bankruptcy. Notifications are connected to relevant actions to make it easy to execute follow-up tasks such as docket monitoring, claims filing, and reaffirmation agreements.

Advanced Case Monitoring

Get notifications of important case events with advanced case monitoring. BankruptcyWatch connects case outcome notifications with your portfolio to get notified when something important happens. BankruptcyWatch also provides groundbreaking docket event monitoring using the latest breakthroughs in machine learning and artificial intelligence to bring next-generation docket event notifications to your fingertips.

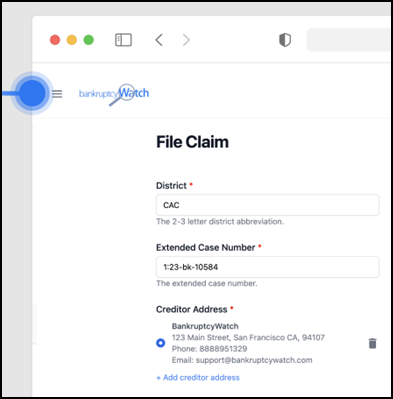

Execute your bankruptcy Proof of Claim strategy flawlessly with the BankruptcyWatch connection. File a Proof of Claim through a connected form, liquidate the claim with a click, or work with a partner to manage the Proof of Claim. View and manage all of your Proof of Claim operations through your Proof of Claim page.

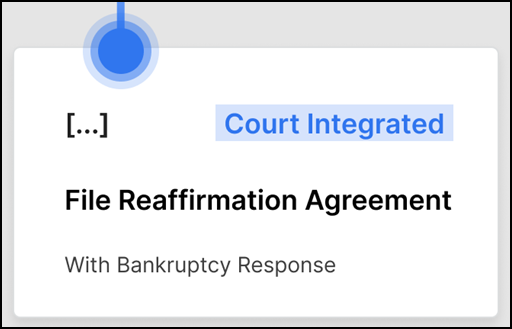

Configure your parameters and automatically generate and submit reaffirmation agreements for every chapter 7 without staff intervention. These tools are specifically designed to simplify the process of reaffirming a debt. Lenders can draft, review, and file reaffirmation agreements. Management tools make it easy to track the status of each agreement, receive notifications about key milestones or required actions, and ensure all aspects of the reaffirmation process comply with bankruptcy regulations while increasing the likelihood of a successful outcome.

Through our collaboration with BankruptcyWatch, you can access the latest bankruptcy technology improved weekly. Beyond the core features mentioned, this partnership is built to facilitate ongoing innovation and expand the capabilities of bankruptcy automation. This means you can look forward to continuous enhancements in case monitoring, data analytics, and automation. Stay ahead of industry trends and regulatory changes with the most advanced tools and strategies to navigate bankruptcy proceedings effectively.

Founded in 2007, BankruptcyWatch embarked on the mission to make bankruptcy operations easy. Through industry-leading API-first bankruptcy tools, they help organizations incorporate live bankruptcy automation directly into native workflows. Reach out to us at sales@bankruptcywatch.com.

About Shaw Systems

Shaw Systems is a leading provider of modern web-based servicing and collections software with over five decades of experience. We provide out-of-the-box loan servicing configuration and business rules so your team can hit the ground running. Our pre-configured product allows any size lender to accelerate their project and leverage best practices right away.

If you'd like to learn more about BankruptcyWatch and Shaw Systems, reach out to us at solutions@shawsystems.com.